VALUE ACCRETIVE ENTRY STAGE

Investors get an opportunity to enter at land stage; with no risks on land quality

HEALTHY RETURNS

Investors enjoy developer returns without any operational challenges of projects

IN HOUSE DEVELOPMENT ARM

NeoLiv development arm will develop projects on behalf of investors at lowest DM fee in industry

HIGHER MARGIN SHARE

Majority of developer margin will be passed to the investors leading to investors enjoying higher IRR on projects

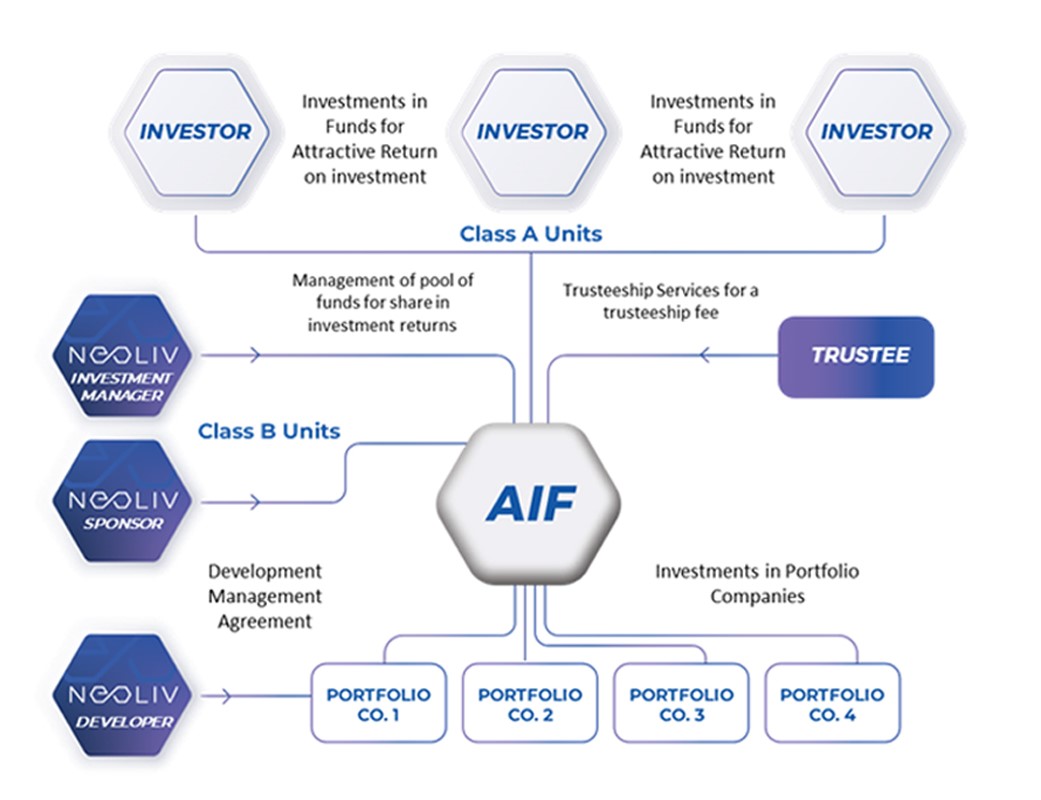

SEBI Approved and Regulated Domestic Equity Fund

NeoLiv has secured approval (Reg No. IN/ AIF2/ 22-23/ 1235) from India’s apex regulatory body for CAT II AIF (Alternate Investment Fund) and plans to raise USD 150 Mn equity capital.

Strategic Equity Investor

360 ONE (Formerly IIFL Wealth) ENTERS INTO A STRATEGIC PARTNERSHIP WITH NEOLIV AS A MINORITY EQUITY INVESTOR.

India’s leading wealth and alternates-focused asset firm, 360 ONE has more than USD 40 billion in assets under management and helps over 6,800 HNI and ultra-HNI families, manage, grow, and preserve their wealth and legacy. (https://www.360.one/)

“Over the past few years, there has been a vacuum created in the residential fund and development space, where we see strong demand as the country’s middle-income segment continues to grow.

We are pleased to be working with the NEOLIV team who bring on board a highly credible track record of capital raise, business development, governance, execution and customer satisfaction to further capitalize on opportunities in this space and believe this investment will deliver strong risk-adjusted returns for all beneficiaries”.

- Karan Bhagat, Founder, MD & CEO, 360 ONE